Forex license

Last Update: 30.05.2025

The brokerage business remains stable and sustainable even during crises. There is a high demand for forex services on the market, which makes it an economically promising business. Turn to Gofaizen & Sherle for professional support to open a Forex broker license with a turnkey solution for the successful launch of a Forex company

Forex is a large financial market with a daily turnover of $6.6 trillion, outperforming the major stock markets. It includes over 9 million online traders. Volatility drives new entrants, with trading activity growing by 300% in 2020 alone. Consequently, according to various statistical studies, the numbers will continue to grow exponentially.

If you want to open a company in this industry, you need to get a Forex broker license. Forex License is an official document from the regulatory authorities for allowing companies (brokers) to work in the foreign exchange market. It guarantees that the business functions to the established financial norms and standards. The work of the broker without possession of the license is considered to be illegal.

Each brokerage firm must obtain a Forex trading license to work in the international brokerage market. This requires an application to the controlling authority of the chosen country. The rules for obtaining a Forex license may vary depending on the laws of the selected country.

Request more information about the Forex license

What is a Forex license?

A Forex license is an official permit provided by competent regulatory authorities for legal work on the currency market. Its presence at the broker indicates that it works within the framework of certain standards and laws, which in turn guarantees its clients a certain level of protection and service. A Forex trading license is the main requirement for legal work of brokerage companies that provide clients with the opportunity to trade on the forex market or engage in currency trading independently.

One of the key aspects of a forex broker license is the protection of investors’ interests. Due to the strict requirements for licensed brokers, clients can be sure that all operations are transparent and that there are no financial frauds on the part of the broker. Moreover, brokers are regularly audited, which provides additional control over their activities. A license can be obtained by companies that comply with the regulations of a certain jurisdiction where they intend to operate. Often these regulations include conditions on capital adequacy, security of client funds, transparency of operations, compliance with the principles of fair trading, anti-money laundering measures, and risk control.

Forex trader license also plays an important role in forming the broker’s reputation in the market. For many traders, the presence of a broker’s license becomes a decisive factor when choosing a trading platform. In addition, a licensed broker can work in many countries where there is a restriction on Forex activities for unlicensed companies.

Thus, a licensed forex broker is a guarantee of quality of services and safety for clients, and for the broker – a tool that provides confidence and legality of its activities in the international market.

How to start a forex business from scratch

Starting a forex business requires thorough preparation procedures and a lot of serious decisions related to risks and obstacles. Every step affects the success of the venture. The basic decision is to decide on a jurisdiction where Forex is regulated according to local laws and also stay within your budget, matching the timing and tax optimization goals. A wrong choice can lead to financial losses.

First, you should get your business registered and get a Forex broker license.

Before contacting the regulatory authorities, consider the following aspects:

- The amount of money you are willing to invest in developing your business. Prices for the licensing process can vary significantly depending on the jurisdiction.

- Check that the financial institution of your choice can meet your business corporate account needs.

- The jurisdiction where you plan to do business. It should be an entity with a sound legal infrastructure, a transparent economic warrant, and a stable local currency.

- Timeframe for registration that suits you. The timeframe for issuing a license can range from 2-3 weeks to 1 year, according to the state you choose.

- Consideration of taxation peculiarities of the jurisdiction you are considering for your business.

An important criterion for a successful business introduction is the choice of a reliable legal partner. Gofaizen & Sherle will prepare all necessary documents, consult you on the choice of jurisdiction, and accompany you through every step of opening a Forex company.

Advantages for obtaining a Forex License

Building trust of clients and partners

Having a forex license increases the level of trust from clients and partners, which confirms the reliability and professionalism of the broker or platform.

Transparency and fair trading

Licensed forex companies ensure full transparency of their operations to prevent any fraudulent activities and comply with the principles of fair trading.

Access to corporate banking services

A license makes the process of opening a corporate bank account much easier, as many banks and financial institutions prefer to work with licensed businesses.

Effective risk management

Regulators pay special attention to risk management, which provides additional protection of clients’ interests and contributes to the stability of the forex business.

Expansion of business in other countries

License forex brokers can serve as a basis for further expansion of the broker’s business in other countries, thanks to international agreements and recognition of the license in different jurisdictions.

Requirements for obtaining a Forex Broker License

- Preparation of company documentation, such as copies of the founders’ passports; diplomas confirming education in finance; certificates of criminal records for the beneficiaries. It is necessary to notarize all documents;

- Registration of the company as an active trading company;

- Proof of capital stock. The amount may vary depending on the jurisdiction. For example, the requirement of Mauritius regarding the share capital is $18,000;

- Development of a realistic business plan;

- Development and implementation of AML/KYC procedures;

- Open a corporate bank account;

- Provide an utility bill to prove your address;

- Having a physical office and commitment to appoint a board of directors and their residency may be present in some jurisdictions;

- Apply for a Forex trading license with the appropriate regulatory organization;

- Once licensed, cooperate with the regulator, comply with all obligations, and do not violate the local laws of the chosen jurisdiction.

Procedure for obtaining a Forex license

Depending on the selected jurisdiction, the Forex License process may differ. Regulatory authorities have unique requirements for licensing, but there are standard principles, which Gofaizen & Sherle experts have compiled into certain algorithms of action:

DETERMINE THE JURISDICTION FOR LICENSING

Step 1

Forex License’s basis is choosing an appropriate jurisdiction. Careful analysis is required to choose the country that matches your requirements, the intended operations, and the economic environment for your target audience.

For this step, it is important to consider all the conditions for licensing, including initial capital requirements, economic criteria of that country, licensing terms, and legislation.

To take this step, it is important to consider all the conditions for licensing, including initial capital requirements, economic criteria of the country in question, licensing time frames, and legislation.

To consider the right conditions for your business model, we recommend contacting Gofaizen & Sherle. Choosing the right jurisdiction will protect you from material losses, save time and help you achieve your goals.

REGISTERING YOUR COMPANY

Step 2

The stage of business registration is a very important step, which requires careful attention to detail and a thorough study of legal provisions and legislation of the jurisdiction where you are going to do business.

You will be able to start the process of registering your company at the local registry of companies, after collecting and checking all the necessary documents: articles of incorporation, powers of attorney, KYC, and others.

After successful company registration, you will receive all corporate documents, which confirm the official registration of the company and will be useful for the next steps of obtaining a Forex broker license.

OPEN A COMPANY BANK ACCOUNT

Step 3

It is important to open a corporate account before applying for a Forex broker license – this is a requirement of many regulators.

Gofaizen & Sherle can help you to find a reputable bank, gather the necessary documents and open an account for the company.

PREPARE THE NECESSARY INFORMATION

Step 4

Assemble a complete package of documents for licensing.

Unfortunately, there is no general sample of documents that will comply with each country’s regulations. However, most often there are requirements to prepare a realistic business plan, details of key employees, proof of funds, insurance, AML/CFT.

COMPLY WITH REGULATIONS AND LAWS

Step 5

Depending on the jurisdiction, you may need to confirm a local office, hire local employees, develop and implement internal AML/KYC rules, etc.

LICENSE APPLICATIONS

Step 6

Your application must contain all necessary information and documentation as per local requirements. Regulators may ask for additional information or clarifications on specific points of the application or even invite you for an interview.

Gofaizen & Sherle facilitates the process of applying for a Forex License by providing you with all the necessary instructions and guaranteeing you comprehensive information on the requirements and processes of the jurisdiction you wish to work in. We support you every step of the way to ensure that the process is completed successfully, even when working remotely.

Company registration

Registering a Forex company is a multi-step process and involves complying with several legal requirements.

Corporate laws and regulations may vary from country to country. At the same time, there are general rules. During the registration process, it is necessary to:

- establish and sign a lease agreement for a corporate office,

- identify shareholders and directors,

- provide a business plan,

- assemble the company’s documentation package,

- register authorized capital,

- pay government fees.

Applying for a forex broker license

Before you start your activities as a Forex Broker in countries where a Forex license is required, you need to apply for a Forex license along with the necessary documentation.

To successfully obtain a license for currency operations, the following steps must be followed:

- Prepare a set of documents required by the supervisory authority.

- Pay the license review fee and, if necessary, the annual fee.

- Submit a formal application with all attached materials to the regulatory authority.

- If required by the regulatory authority, participate in a personal audience or provide additional information.

The required application documents typically include:

- The basic document of a company’s articles of incorporation.

- The company’s founding materials.

- A detailed business plan presenting key operating assets, market strategies, financial estimates, and risk management measures.

- A detailed risk control plan.

- Photocopies of passport details of shareholders, management, and other key personnel.

- Residence registration documents for shareholders, executives, and important team members.

- Professional references of senior staff showing their professionalism and experience in foreign exchange operations.

- Criminal record-free identification for shareholders, management, and key executives.

- Detailed AML/CFT compliance materials, detailing relevant corporate regulations.

During the application process, you may encounter standard requirements: payment of a license fee, submission of proof of identity and residency, submission of bank and professional references, submission of your resume, and passing a criminal background check. These requirements vary by jurisdiction and by regulatory agency.

Jurisdictions that do not require a Forex broker license may have other regulations that must be followed. If this is the case, it is advisable to consult Gofaizen & Sherle for detailed information about the requirements and obligations.

After obtaining a Forex license, the next step is to set up a payment system.

You will need to set up payment accounts and connect to payment systems through the appropriate companies. Such companies may require information about your license and company to verify your legitimacy to provide their services. You may also need additional training or support to satisfy certain rules of the payment companies.

Forex Lawyers

Position

Senior Associate, Head of Sales (FX and iGaming)Phone

+372 5300 1858

Position

Senior Associate, Business Development Manager (FX & iGaming)Phone

+372 5477 0344Request additional information about the Forex license

Jurisdictions for obtaining a Forex license

When choosing which jurisdiction to apply for a Forex License, you must take into consideration things like the controls imposed by regulators, how long the licensing period will be, the cost of government fees, and the image and political stability of the country. The most influential jurisdictions for the operation of a brokerage company are usually located in developed countries, such as the United States and the United Kingdom. Obtaining a Forex license in these countries can strengthen a broker’s position, favorably affect its reputation and increase the degree of trust from traders. However, these options will require a significant time and capital investment. As cheaper alternatives, you can consider jurisdictions such as Vanuatu, Seychelles, Mauritius, St. Vincent and the Grenadines or Comoro Islands.

Forex License in Mauritius

Obtaining a Forex license in Mauritius is promising, primarily due to its stable political environment and robust financial system. The local Financial Services Commission (FSC) enforces clear and specific regulations, providing additional reassurance to customers.

The minimum capital requirement is $18,000, and the cost of the license ranges from $20,000 to $25,000. The period of obtaining it is about 3 months.

Explore

Forex License in Seychelles

Obtaining a Forex license in Seychelles is quite profitable due to the fast, relatively inexpensive licensing process and a loyal tax environment. Companies are regulated by the Financial Services Authority (FCA), which provides comfortable conditions for licensing.

The minimum capital is $50,000, and the cost of the Forex license ranges from $35,000 to $45,000. The time of obtaining it is about 2-3 months.

Explore

Forex License in SVG

Obtaining a Forex license in SVG is not difficult, as there are no licensing requirements for Forex brokers yet. International brokerage companies (IBCs) are not regulated by the Financial Conduct Authority (FCA), but the regulator can warn about possible risks.

In SVG there are no requirements for registered capital and the business can be opened within 3 weeks.

Explore

Forex License in Vanuatu

Vanuatu joins the list of popular jurisdictions for Forex brokers due to its minimum capital requirements, minimal tax obligations, and quick licensing process. Forex broker license in Vanuatu does not imply work only in this sphere but provides a prospect to work as an authorized dealer in the sphere of securities and finance.

The registered capital is $50,000 and the Forex license can be obtained within 2 to 3 months.

Explore

Forex License in Comoro Islands

Obtaining a Forex license in the Comoro Islands offers numerous advantages for financial service providers. The country provides a favorable business environment, competitive tax rates, and a simplified regulatory framework. The Central Bank of Comoros oversees financial activities, including Forex trading, ensuring compliance with regulations. Companies seeking a Forex license must demonstrate financial stability, possess adequate infrastructure and technology, adhere to AML and KYC regulations. Once granted, the license enables companies to offer Forex trading services globally. The Comoro Islands’ strategic location between Africa and Asia also offers opportunities for expanding into emerging markets.

The registered capital is $50,000, and the cost of the Forex license ranges from $35,000 to $41,000. The time of obtaining it is about 3-4 weeks.

Forex License in Georgia

Georgia offers a promising environment for Forex companies, featuring a streamlined licensing process and favorable tax conditions. Since April 2018, obtaining a forex license in Georgia has been mandatory for brokers, regulated by the National Bank of Georgia. The country’s low profit tax of 5% and exemptions from payroll and dividend taxes make it an attractive option for businesses operating in both European and local markets.

The minimum capital requirement for obtaining a Forex license is 100,000 GEL (approximately 30,000 USD), and licensing can be completed in about a month—faster than in many other jurisdictions.”

Forex License in the UK

“The United Kingdom offers a robust regulatory environment for Forex companies, overseen by the Financial Conduct Authority (FCA). To obtain a forex license in the United Kingdom, companies must meet strict capital requirements and comply with Anti-Money Laundering (AML) regulations. The UK’s licensing process is thorough, granting access to one of the largest financial markets globally.

The minimum capital requirement is £730,000, with licensing costs typically ranging from £10,000 to £30,000. The process generally takes between 6 and 12 months.”

Forex License in Cyprus

Obtaining a forex license in Cyprus is the best choice for obtaining a Forex license due to its EU membership, low corporate tax (12.5%) and regulation by CySEC. Cyprus offers simplified access to European markets and high investor confidence. Minimum capital requirements range from €50,000 to €730,000 and the cost of a license is around €20,000 with additional fees. The period to obtain a license usually takes 6-12 months.

Explore

Forex License in Saint Lucia

Saint Lucia offers an appealing environment for Forex businesses due to its minimal tax burden and quick setup process. Forex activities became regulated in 2022, requiring companies to obtain a forex license in Saint Lucia from the Financial Services Regulatory Authority (FSRA).

The minimum capital requirement is no, and the cost of the license $8,680, including all fees. The period of obtaining it is about 3-6 months. Please note, that forex companies that operate on CFDs outside of the Eastern Caribbean region can operate without a license. In this case, it takes 1-2 weeks to register your business.

Forex License in Antigua and Barbuda

Antigua and Barbuda is an attractive option for forex brokers seeking a quick and cost-effective way to start operations. The jurisdiction offers minimal requirements for obtaining a forex license in Antigua and Barbuda, especially for companies operating outside the region. Companies must register a business, appoint a director and shareholder, and rent a local office.

There are no capital requirements for obtaining the license, and the cost starts at $4,600, including government fees. The process typically takes around 4 weeks.

Forex License in Anjouan

Anjouan, which is part of the Union of the Comoros, offers an attractive jurisdiction for Forex brokers. The process of obtaining a forex license in Anjouan, without strict requirements for local offices or directors. A favorable tax regime, no income tax, and a simplified licensing process make Anjouan a popular choice for Forex businesses.

The minimum required capital is USD 50,000, and the license fee starts from EUR 29,950, depending on the company structure. The period for obtaining a license usually ranges from 1 to 3 months.

Forex License in Labuan

“To obtain a forex license in Labuan, brokers benefit from a favorable tax regime, the possibility of 100% foreign ownership, and access to Asian markets. Labuan is a strong contender for forex businesses seeking a tax-efficient, internationally recognized jurisdiction.

The minimum capital requirement is RM500,000 (approximately $110,000), and the cost of the license starts at $1,250 annually. The period of obtaining it is about 3 months.”

Forex License in Dominica

Dominica offers a favorable environment for obtaining a forex license in Dominica due to clear regulations, cost-effective processes, and a supportive legal framework. This jurisdiction appeals to financial entrepreneurs seeking secure and strategic market entry.

The minimum capital requirement is $100,000, while the cost of the license typically starts at $5,000 annually. The licensing process usually takes between 1 and 2 months.

Forex License in the BVI

The British Virgin Islands are known for their advantageous legal structure and well-regarded financial regulations, making it a prime jurisdiction for acquiring a forex license in the BVI . The region offers a strong reputation for financial services, appealing to those seeking a globally recognized framework.

The minimum capital requirement ranges from $100,000 to $250,000. The cost of the license varies greatly depending on factors like business size and complexity. The licensing period is approximately 3 months, depending on regulatory compliance and documentation.

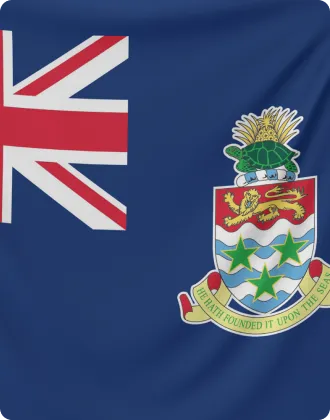

Forex License in the Cayman Islands

Obtaining a forex license in the Cayman Islands is an attractive jurisdiction, thanks to a strong regulatory environment and favorable tax policy. The Cayman Islands Monetary Authority (CIMA) oversees all financial services, ensuring compliance with international standards and investor protection.

The minimum amount of capital is USD 125,000, with additional application fees and annual fees. The licensing process usually takes 3 months.

Forex market business models

There are 3 basic business models in Forex:

Market making model (Market maker)

The Market Maker model implies that the company can process transactions for its clients, provide liquidity in the market and earn commissions. This model implies that the company itself bears all trading risks.

- Profits are made at the expense of client losses;

- Even during periods of low volatility, revenues remain stable;

- The company itself is a party to the transaction;

- The role of the intermediary is performed by the company.

Agency model

The company acts as an intermediary, taking orders from traders and sending them to liquidity providers.

- Profit is generated from the total volume of trades, and it does not depend on the client`’s profit;

- Profit is directly related to the trading volume;

- All trades are automatically transferred to the bank account;

- The company independently sets and publishes buy and sell prices on its platform.

Hybrid model

It combines the activity of an agency model and a market maker. Hybrid allows combining all mentioned aspects into one model.

Regulation of the Forex market

There is a regulator that supervises the work of brokers. It can be the local government or representatives of the independent financial commission. Its main task is to prevent the circumstances when the Forex broker does not fulfill his obligations to the traders and to give them legal protection. The regulator acts as a legal advocate for investors and clients.

The main duties of the regulator about forex brokers: checking for compliance with the rules of the license, regulating the observance of these rules, and canceling the license in case of violation of the requirements.

The regulator also reviews client appeals and conducts periodic audits of the company`’s activities to verify possible violations of the rules or compliance with license requirements.

In the regulation of the Forex market, it is important to note that the organization that issued a license to a broker in a particular jurisdiction can only support local traders and investors. For example, if a broker has been issued an FCA license (UK), the regulation only applies to UK citizens.

In some countries, the company does not have to obtain a Forex license. In this case, the broker may formalize as a legal entity offering financial services and work globally through the Internet without additional protection and support from the regulatory authorities.

Reporting and license renewal

Forex brokers are required to submit company reports to the regulator, who also has the power to conduct unannounced financial audits.

In case of violations, non-payment of state fees, or suspension of services for more than six months, the license can be revoked.

Depending on the jurisdiction in which the company operates, it may be required to pay the state fee for the renewal of the Forex license, to pay annual fees, and to report on revenues and taxes paid at least once a year.

It is important to remember that maintaining full and transparent reporting is key to maintaining trust and compliance with the law. Reporting not only allows regulators to exercise control but also helps establish transparency and protect traders`’ interests.

Conclusion

Forex licensing is at the heart of building a reliable and stable business, allowing companies to guarantee their legitimacy and gain the trust of their clients. This key document confirms compliance with high standards of transparency and integrity and facilitates interaction with financial institutions.

For those who seek to successfully develop and expand their business in the international market, having a Forex license will be the best solution. By contacting Gofaizen & Sherle, you will receive all the assistance you need in the process of obtaining a forex trader license, allowing you to focus all resources on your company’s core business.

FAQ about Forex license

What types of Forex licenses are available?

Forex licenses are divided into levels. The Prime Category A (USA, Switzerland) requires capital starting from $20 million. Universal license B (UK, Australia) starts from $100,000. Category C (New Zealand, Malta, Cyprus) from $30,000. Category D (Vanuatu, Cayman, BVI) – from $25,000.

How much does it cost to obtain a Forex license?

The cost of a Forex license varies depending on the jurisdiction and type of license. Some countries like Vanuatu or Seychelles offer licenses at relatively low cost. However, in more heavily regulated countries like the United States or the United Kingdom, the cost of a license can reach several hundred thousand dollars.

How do I get a forex trading license?

Obtaining a Forex broker license requires the following steps: choose a suitable jurisdiction for licensing, register your company, open a corporate bank account, and prepare all necessary documents for licensing. Then you need to meet all requirements of the chosen regulator and apply for a Forex license.

How long does it take to get a FX license?

Obtaining an FX license can take several months to a year, depending on the jurisdiction and the quality of the documents submitted.

How to start a forex brokerage firm?

In the process of Forex company registration, it is necessary to determine shareholders and directors, submit a business plan, collect a package of documentation, register authorized capital, and pay state fees.

Which forex license is best?

The best forex broker license depends on your business goals and the market situation. Licenses from highly regulated countries, such as the UK or the US, are considered the most prestigious.

Do forex traders need a license?

Traders working with their funds do not need a Forex license. However, if they manage other people’s funds, licensing may become mandatory.

Connect with our experts

Our experts will tell you how to do it as quickly and easily as possible.

By clicking the button, I confirm that I have read the privacy policy and consent to the collection and processing of my personal data in accordance with the GDPR rules.